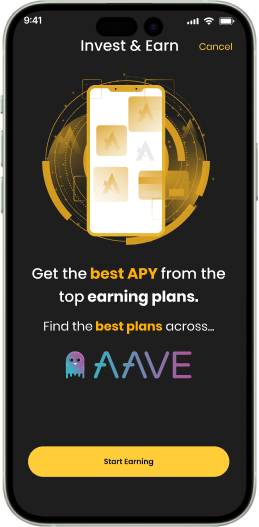

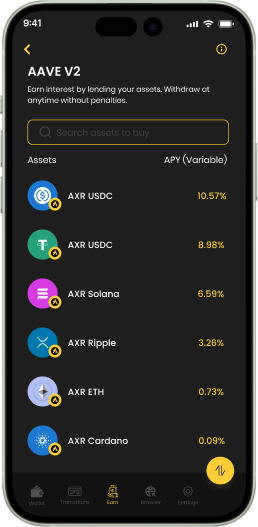

Follow easy steps to invest your crypto and earn rewards fast

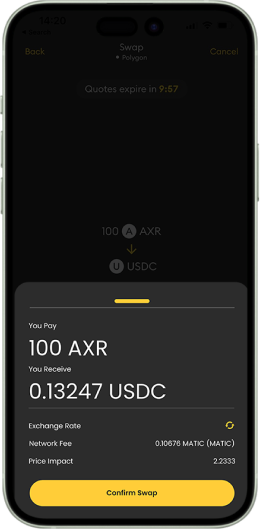

Revenue Predictor

Projected profits based on current APR *

NativeEvmos %31

100

- Daily Earnings

- Daily Earnings

- Daily Earnings

- + 0.07492677 EVMOS

- + 2.30431753 EVMOS

- + 31.44 EVMOS

Available Assets for Staking

Cosmos

APR 13.77%

Polkadot

APR 14.76%

Solana

APR 5.47%

BNB

APR 4.78%

NativeEvmos APR 31.44%

Stargaze APR 21.88%

Kava APR 6.7%

Terra Classic APR 15%

Kusama APR 15.06%

NativeInjective APR 14.07%

Osmosis APR 8.73%

CryptoOrg APR 6.06%

NEAR APR 7.54%

Stride APR 3.19%

Tezos APR 0.8%

Sui APR 3.7%

Tron APR 5.06%

Cardano APR 4.69%

Juno APR 18.85%

Akash APR 13.19%

Agoric APR 9.55%

Axelar APR 8.45%

Ethereum APR 3.73%

Sei APR 3.53%

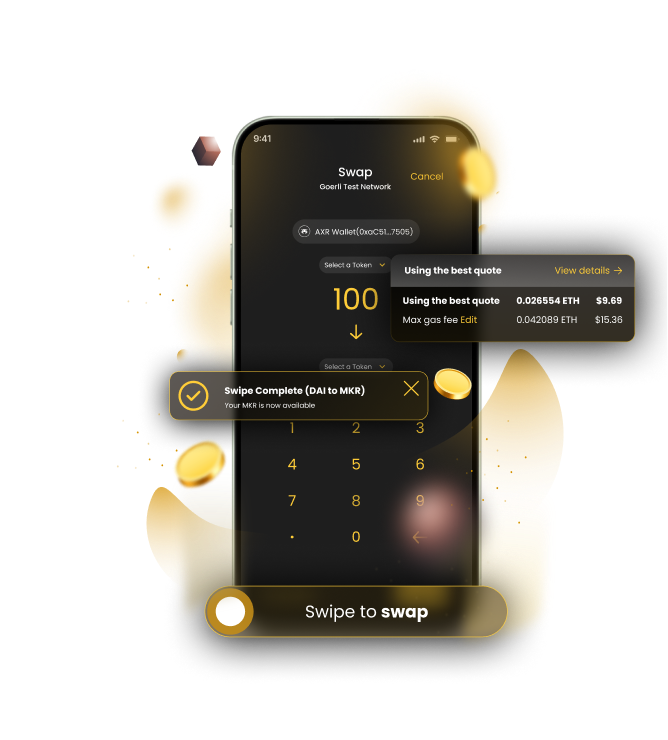

Our investment partners

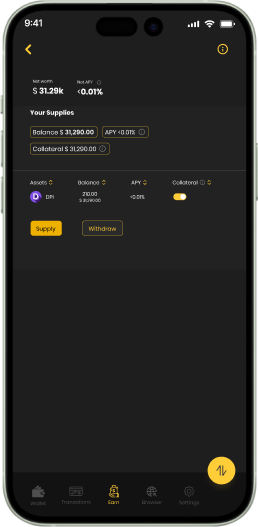

Enjoy Investing with us

0 locking period

Your funds remain accessible and usable without any restrictions or lock-in.

Flexibility & Daily Rewards

AXIR Wallet provides you utmost flexibility and rewards every day

Begin with less as 10 USD

We prioritize cryptocurrency newcomers and aim to offer them straightforward access to begin earning.

Most extensive selection of Assets

AXIR Wallet offers best featured assets with over 150 cryptocurrencies available

Lesser Fees

Minimal charges for withdrawals and deposits

Frequently asked questions

What is Staking in Cryptocurrency?

Staking in cryptocurrency involves holding and locking up a certain amount of cryptocurrency in a wallet to support the operations of a blockchain network. In return for staking, participants may receive rewards in the form of additional cryptocurrency tokens.

What is Liquid Staking ?

Liquid staking involves staking cryptocurrency assets while receiving a liquid representation of those staked assets, allowing users to earn staking rewards while maintaining liquidity and flexibility to trade or use their staked assets.

What is a validator?

A validator in staking refers to a participant in a proof-of-stake (PoS) blockchain network who is responsible for proposing and validating new blocks of transactions. Validators play a crucial role in maintaining the security and integrity of the network and are typically rewarded with additional cryptocurrency tokens for their contributions.

How does staking differ from mining?

Staking differs from mining in that mining involves using computational power to validate transactions and create new blocks on a blockchain network, while staking involves holding and staking a certain amount of cryptocurrency to participate in transaction validation and block creation.

What are the benefits of staking?

The benefits of staking include the ability to earn rewards in the form of additional cryptocurrency tokens, contributing to the security and decentralization of the blockchain network, and potentially receiving passive income through staking rewards.

What is the minimum amount of cryptocurrency required for staking?

The minimum amount of cryptocurrency required for staking varies depending on the specific blockchain network and staking protocol. Some networks may have minimum staking requirements, while others may allow users to stake any amount of cryptocurrency they choose.

How do I start staking my cryptocurrency?

To start staking your cryptocurrency, you typically need to choose a staking-compatible wallet or platform, transfer your cryptocurrency to the staking wallet, and follow the instructions provided by the platform to initiate the staking process.

What are the risks associated with staking?

Risks associated with staking may include the potential loss of staked funds due to network attacks or vulnerabilities, the possibility of slashing penalties for validators who fail to follow the rules of the network, and the risk of fluctuations in the value of the staked cryptocurrency.

How are staking rewards calculated?

Staking rewards are calculated based on various factors, including the amount of cryptocurrency staked, the duration of the stake, and the specific staking protocol used by the blockchain network. Rewards may be distributed periodically, such as daily, weekly, or monthly, depending on the network.

Can I unstake my cryptocurrency at any time?

In most cases, cryptocurrency can be unstaked at any time, but there may be a waiting period before unstacked funds become available for withdrawal. The specific unstaking process and waiting period vary depending on the blockchain network and staking protocol.

How often are staking rewards distributed?

Staking rewards are typically distributed on a regular basis, such as daily, weekly, or monthly, depending on the specific staking protocol and network. The frequency of reward distribution may vary depending on network conditions and other factors.

What is Staking in Cryptocurrency?

Staking in cryptocurrency involves holding and locking up a certain amount of cryptocurrency in a wallet to support the operations of a blockchain network. In return for staking, participants may receive rewards in the form of additional cryptocurrency tokens.

What is Liquid Staking ?

Liquid staking involves staking cryptocurrency assets while receiving a liquid representation of those staked assets, allowing users to earn staking rewards while maintaining liquidity and flexibility to trade or use their staked assets.

What is a validator?

A validator in staking refers to a participant in a proof-of-stake (PoS) blockchain network who is responsible for proposing and validating new blocks of transactions. Validators play a crucial role in maintaining the security and integrity of the network and are typically rewarded with additional cryptocurrency tokens for their contributions.

How does staking differ from mining?

Staking differs from mining in that mining involves using computational power to validate transactions and create new blocks on a blockchain network, while staking involves holding and staking a certain amount of cryptocurrency to participate in transaction validation and block creation.

What are the benefits of staking?

The benefits of staking include the ability to earn rewards in the form of additional cryptocurrency tokens, contributing to the security and decentralization of the blockchain network, and potentially receiving passive income through staking rewards.

What is the minimum amount of cryptocurrency required for staking?

The minimum amount of cryptocurrency required for staking varies depending on the specific blockchain network and staking protocol. Some networks may have minimum staking requirements, while others may allow users to stake any amount of cryptocurrency they choose.

How do I start staking my cryptocurrency?

To start staking your cryptocurrency, you typically need to choose a staking-compatible wallet or platform, transfer your cryptocurrency to the staking wallet, and follow the instructions provided by the platform to initiate the staking process.

What are the risks associated with staking?

Risks associated with staking may include the potential loss of staked funds due to network attacks or vulnerabilities, the possibility of slashing penalties for validators who fail to follow the rules of the network, and the risk of fluctuations in the value of the staked cryptocurrency.

How are staking rewards calculated?

Staking rewards are calculated based on various factors, including the amount of cryptocurrency staked, the duration of the stake, and the specific staking protocol used by the blockchain network. Rewards may be distributed periodically, such as daily, weekly, or monthly, depending on the network.

Can I unstake my cryptocurrency at any time?

In most cases, cryptocurrency can be unstaked at any time, but there may be a waiting period before unstacked funds become available for withdrawal. The specific unstaking process and waiting period vary depending on the blockchain network and staking protocol.

How often are staking rewards distributed?

Staking rewards are typically distributed on a regular basis, such as daily, weekly, or monthly, depending on the specific staking protocol and network. The frequency of reward distribution may vary depending on network conditions and other factors.

Bitcoin(BTC)$108,270.54

Ethereum(ETH)$2,518.31

Tether(USDT)$1.00

XRP(XRP)$2.22

BNB(BNB)$657.08

Solana(SOL)$147.49

USDC(USDC)$1.00

Lido Staked Ether(STETH)$2,518.25

Lido Staked Ether(STETH)$2,518.25Dogecoin(DOGE)$0.164295

TRON(TRX)$0.283358